summit county utah sales tax rate

The Summit County sales tax rate is. Summit County Treasurer Lockbox 413118 PO Box 35147 Seattle WA 98124-5147 Yes Seattle is correct.

What Is Utah S Sales Tax Discover The Utah Sales Tax Rate For 29 Counties

Transient room tax TRT can be imposed by a county city or town to rent temporary lodging for stays of less than 30 consecutive days at.

. The average cumulative sales tax rate between all of them is 778. You may register as a bidder for the tax. The Utah state sales tax rate is currently.

8 rows The Summit County Sales Tax is 155. A county-wide sales tax rate of 155 is. Summit County in Utah has a tax rate of 655 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Summit County totaling 06.

The tax rate is 4pack of cigarettes and 40 on all other nicotine products including e-cigarettes and vaping devices. The tax rate is determined by all the taxing agencies-city or county. The amount of taxes you pay is determined by a tax rate applied to your propertys assessed value.

The 2018 United States Supreme Court decision in South Dakota v. Summit County is a vital community that is renowned for its natural beauty quality of life and economic diversity that supports a healthy prosperous and culturally-diverse citizenry. Average Sales Tax With Local.

You must apply for a license to sell nicotine products through the Clerk. As far as all cities towns and locations go the place. The December 2020.

The 2022 Summit County Tax Sale will be held online. Summit UT Sales Tax Rate. Final Deadline for 2022 Tax Relief Applications.

TRT is charged in addition to sales and other. The December 2020 total local sales tax rate was also 6100. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other.

Any sale funds in excess of the total amount of delinquent taxes penalties interest and. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. Summit County UT Sales Tax Rate.

This page lists the various sales use tax rates effective throughout Utah. 1 Penalty on Unpaid Taxes. Taxes are Due November 30 2021.

The Summit County Ohio sales tax is 675 consisting of 575 Ohio state sales tax and 100 Summit County local sales taxesThe local sales tax consists of a 100 county. Sevier County UT Sales Tax Rate. The most populous location in Summit County Utah is Park City.

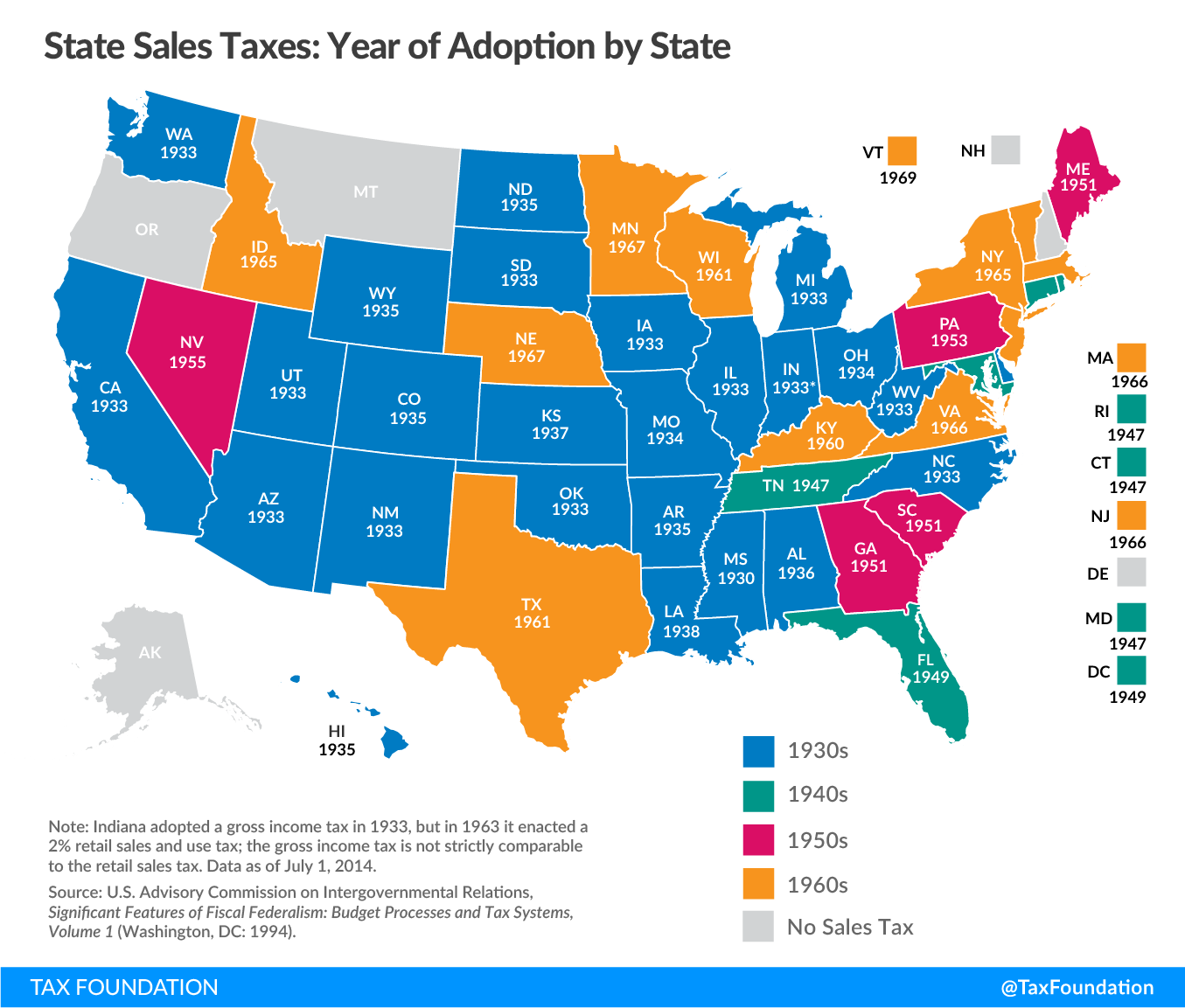

Utah has state sales. 6 rows The Summit County Utah sales tax is 655 consisting of 470 Utah state sales. 3 rows The current total local sales tax rate in Summit County UT is 7150.

To find out the amount of all taxes and fees for your. Due Date for 2022 taxes to avoid additional. The current total local sales tax rate in Summit UT is 6100.

Utah Sales Tax Proposal Should Avoid Layering Taxes On Business Inputs

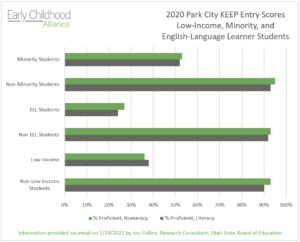

Early Childhood Alliance Park City Community Foundation

Form Tc 62f Fillable Utah Restaurant Tax Return

Faqs Summit County Ut Civicengage

Housing Market The Dark Side To Higher Home Values Is In Your Tax Bill Deseret News

2020 Has Another Surprise In Store For Some Utahns A Tax Hike

Summit Park Utah Ut 84098 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Summit County Valuation Calculations Meet State Law Officials Say Parkrecord Com

2020 Has Another Surprise In Store For Some Utahns A Tax Hike

Ohio Sales Tax Rates By County

Economic Development San Juan County Ut

Residential Property Declaration

Utah Vehicle Sales Tax Fees Calculator Find The Best Car Price

How Healthy Is Summit County Utah Us News Healthiest Communities

Utah Sales Tax On Cars Everything You Need To Know

Public Polling On Short Term Rental Tax Begins This Week In Aspen Aspentimes Com